Corporate

Governance

Maintaining excellent corporate governance policies and practices ensure the Institute is able to carry out its statutory responsibilities and commitment to facilitating a smooth transition as members and the public gear up for major changes within the profession and beyond.

Major governance developments

During the financial year there were four major governance developments.

Issuance of inaugural global sustainability disclosure standards

On 26 June 2023, the International Sustainability Standards Board (ISSB) published its two inaugural IFRS Sustainability Disclosure Standards: IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information and IFRS S2 Climate-related Disclosures.

The Institute is committed to promoting sustainability and contributing to global efforts to address environmental and social challenges. In addition to pressing forward with developing its role as Hong Kong’s statutory sustainability standard setter and involvement in the international standard-setting arena, the Institute will also focus on upskilling stakeholders with the necessary knowledge in these areas.

Further regulatory reform of the accounting profession

As of 1 October 2022, the Institute’s former regulatory roles in the issuance of practising certificates, registration and inspection of practice units and regulating the professional conduct of all CPAs and practice units have been formally transferred to the Accounting and Financial Reporting Council (AFRC) under the further reform of the regulatory regime of accounting profession.

With the transfer of functions, the Institute continue to shoulder the responsibilities of incubating talents, developing Hong Kong’s accounting profession as well as setting industry standards.

While the Institute’s disciplinary functions were transferred to the AFRC, it continued to complete ongoing cases referred to the Disciplinary Committee prior to 1 October 2022. Within the fiscal year, six disciplinary orders were processed while six cases remain.

Reviewing of the Institute’s Council election arrangements

The Professional Accountants (Amendment) Bill 2022 was passed in Legislative Council (LegCo) on 13 July 2022. The bill makes amendments to the Professional Accountants Ordinance (Cap. 50) (ordinance) to raise requirements for election to the Institute’s Council by increasing the number of nominations required from CPAs from the current two (one proposer and one seconder) to 10 (one proposer and nine seconders), and imposing a new requirement for obtaining nominations from two members of the Advisory Committee of the AFRC as seconders. The amended ordinance also aligns the election cycle of all 14 elected Council members to a biennial cycle and enhances the administrative procedures for conducting Council elections and general meetings of the Institute. The amendments took effect on 1 November 2022.

According to the transitional arrangement, the term of office of the 14 incumbent elected members of the Institute’s Council will draw to a close in end-2023. The enhanced election arrangement will commence operation at the Council election to be held then.

Strategic Plan 2023

This year, the Institute is celebrating its 50th anniversary. As we enter this new era, it is more important than ever to have a clear and concise roadmap to account for the Institute’s success now and beyond. After reviewing progress made under the recent plan, the Council and the Institute have updated and refined our strategic plan based on a number of key factors and considerations.

The Strategic Plan 2023 has built on the three key areas included in the previous plan for repositioning the Institute, and has updated them to better convey essential considerations, namely:

- Delivering member value;

- Standing and future of the profession;

- Be a sustainable and versatile Institute.

The updated Strategic Plan 2023 has been made available on our website for stakeholders to find out more about our plans.

The Council

The Council serves as the governing body of the Institute, makes decisions on the overall strategy, policy and direction, as well as handling matters stipulated in the Professional Accountants Ordinance. It provides guidance on the Institute’s governance and operations with the assistance of relevant boards and committees.

Through a balance of members from within and outside the profession, the Council benefits from a wide scope of views when debating and addressing issues.

Composition

The composition of the Council is governed by the Professional Accountants Ordinance. The Council consists of 14 individual CPAs directly elected by the membership and six government-appointed members to provide independent views, including two ex-officio government members, and four lay members of high standing in society. The Immediate Past President who completed his elected term also remains on the Council for an additional year to provide continuity. The Council may co-opt an additional two members at the start of its term. All members are non-executive and non-compensated.

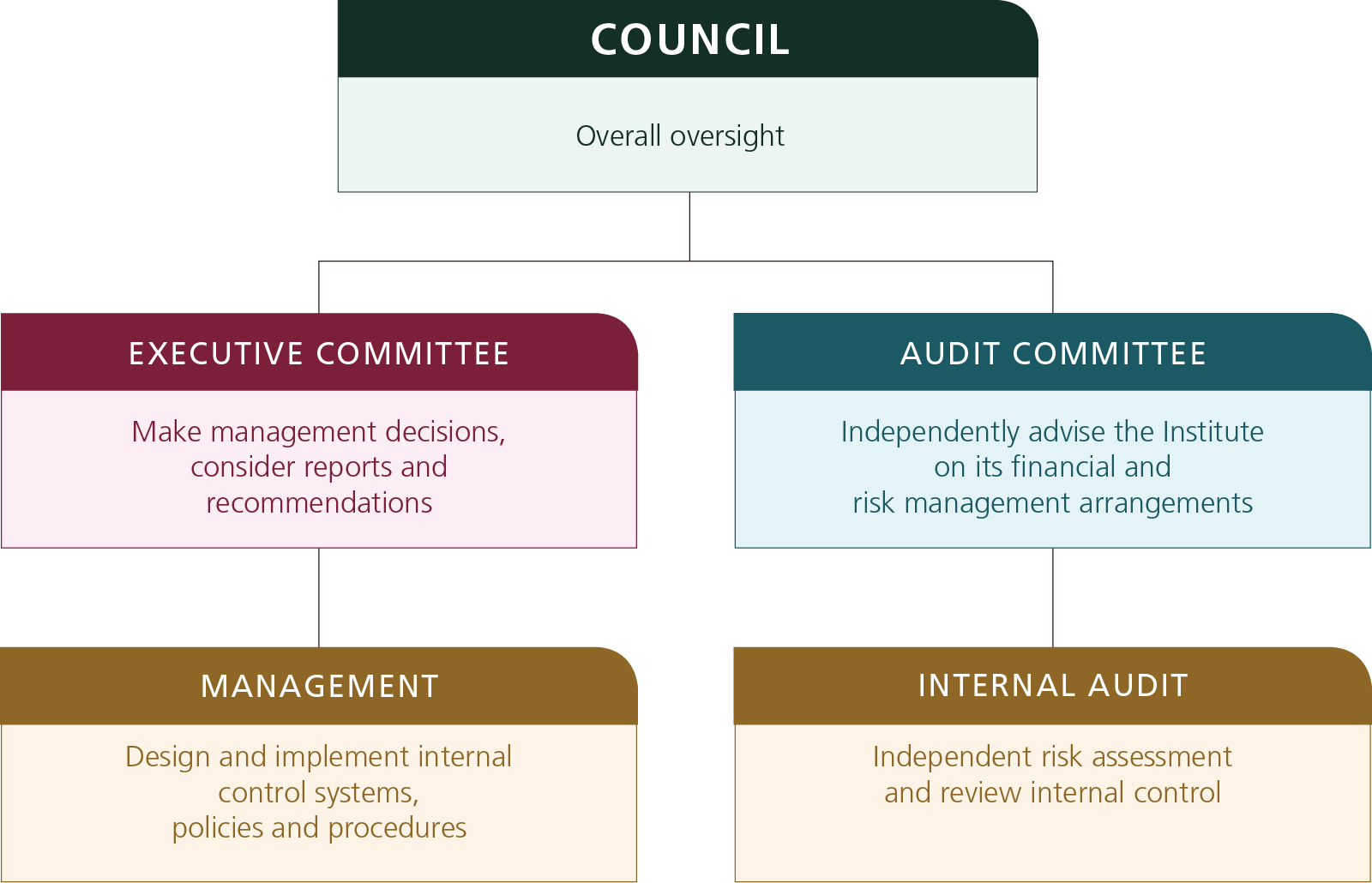

GOVERNANCE STRUCTURE

According to the transitional arrangement following the adoption of Professional Accountants (Amendment) Bill 2022 to enhance the election mechanism, the 14 incumbent elected members of the Institute’s Council from 2022 would continue into 2023 and their terms of office will draw to a close in end-2023. The enhanced election arrangement will commence operation at the Council election to be held then. Therefore, the Institute did not hold an election during the annual general meeting (AGM) in end-2022.

This year, the Council consists of 20 members, and the Immediate Past President is also included in the 14 individual CPAs who were elected by the membership. One member was appointed by the Council in July 2022 to fill the vacancy left by a member who resigned in June 2022.

Term of service

The term of office of Council members is governed by the Professional Accountants Ordinance. Elected Council members serve for two-year terms beginning after the AGM in December. Government-appointed lay members also serve for two-year terms from the appointment date. The ex-officio members serve while holding their official capacity. Co-opted members serve from after the Council meeting when they are appointed, usually early in the Council year, until the next AGM.

Induction

Early in the new Council term, newly elected and appointed Council members are given a briefing and information package by the Institute’s Chief Executive and Registrar to familiarize them with the Institute, its governance and Council operations, and meeting processes, membership statistics and key projects.

Conflict of interest and confidentiality

All Council members follow established rules to avoid conflict of interest, such as exclusion from discussions or decisions where a real or apparent conflict of interest is present. Council members are also not to disclose any information pertaining to their work as a member of the Council.

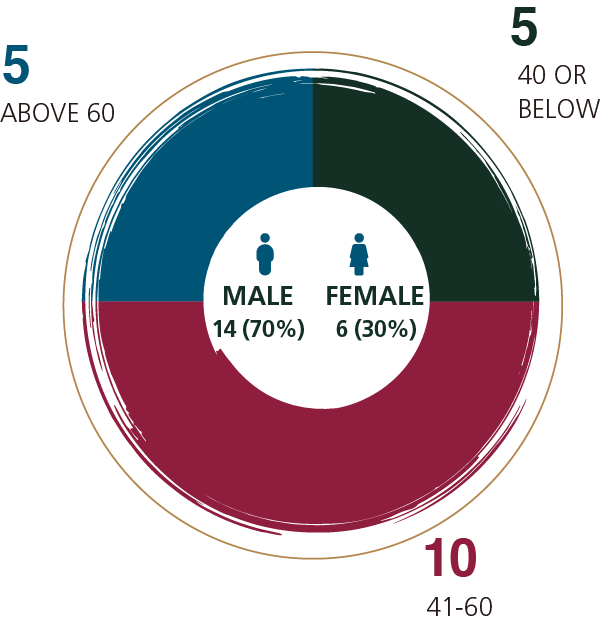

Diversity

To ensure members of different backgrounds are represented, the 14 elected Council members are made up of six CPAs who are in full time practice as certified public accountants (practising) (denoted by the letter “P”); six CPAs who are not in full time practice as certified public accountants (practising), who may or may not hold a practising certificate (denoted by the letter “N”); as well as two CPAs of whom either one or both can be of category P or category N as mentioned above.

In addition, the co-option mechanism should enable Council to review its composition and co-opt suitable Council members if required. As such, Council could leverage on the co-option mechanism to implement any desirable diversity criteria at the start of its term.

DIVERSITY OF THE INSTITUTE’S COUNCIL —

AGE AND GENDER DISTRIBUTION

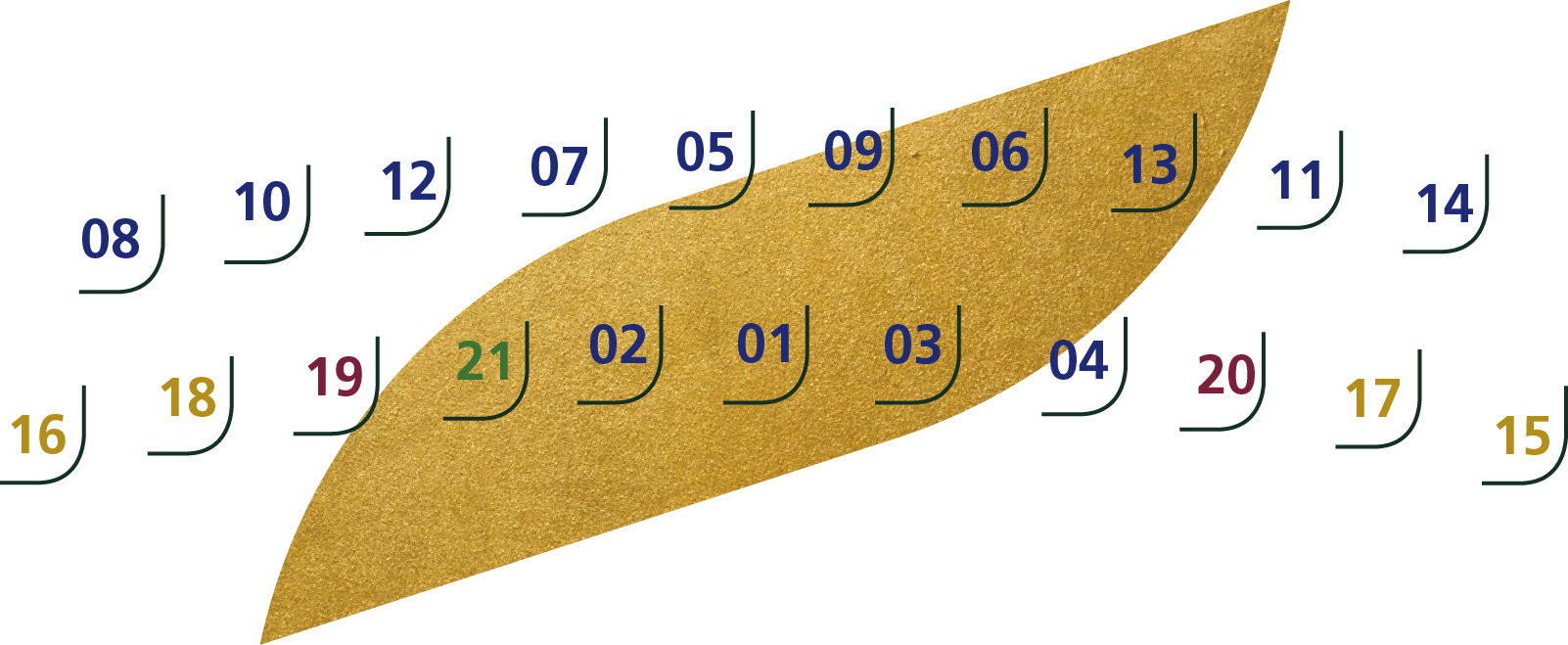

THE COUNCIL

(As of 30 June 2023)Elected members

01 Fong Wan Huen, Loretta CPA (practising) (President)02 Roy Leung FCPA (practising) (Vice-President)

03 Au Chun Hing, Edward FCPA (practising) (Vice-President)

04 Raymond Cheng FCPA (practising) (Immediate Past President)

05 Alan Au CPA

06 Alan Chan FCPA (practising)

07 Larry Cheng CPA (practising)

08 Lam Siu Fung, Frank FCPA (practising)*

09 Stephen Law JP, CPA (practising)

10 Lee Shun Yi, Jasmine CPA (practising)

11 Liu Kwok Tai, Teddy CPA (practising)

12 Prof Tse Hoi Fat, Calvin FCPA (practising)

13 Wong Wing Hei, Ernest CPA

14 Andrew Yung FCPA

Government-appointed lay members

15 Au King Lun MH, PhD16 Agnes Choi Heung Kwan MH

17 Theresa Ng Choi Yuk JP

18 Wong Kam Pui, Wilfred BBS, JP

Ex-officio members

19 Helen Tang JP (Representative of the Financial Secretary, Government of the HKSAR)20 Susanna Cheung JP, FCPA (Director of Accounting Services, Government of the HKSAR)

Chief Executive & Registrar

21 Margaret W.S. Chan CPA (Secretary)- Lam Siu Fung, Frank FCPA (practising) was appointed by the Council, with effect from 20 July 2022, to fill the vacancy arising from the resignation of Prof Lam Chi Yuen, Nelson JP, FCPA (practising) on 24 June 2022.

View the highlights of the biographical details of Council members here. For elected Council members, the year referenced is the Council year, which is the period between two AGMs. For ex-officio and lay Council members, the date of appointment is included. Full biographies can be found on the Institute’s website.

Council processes

The Council conducts its business through regular meetings. Arrangement of the meetings include:

- Meetings are chaired by the President

- Meetings are held monthly

- Eleven members of the Council required for a quorum

- Attendance can be in person, by telephone, video conferencing or other electronic means

- Council meeting agenda is considered and confirmed at the Executive Committee meeting held prior to each Council meeting

- Normally two rounds of Council paper distribution, the first seven calendar days before the meeting and the second as necessary

- Council minutes are produced for each meeting, with one set of abridged minutes uploaded to the Members’ area of the Institute’s website

The Chief Executive and Registrar, as Secretary to the Council, is responsible for ensuring that related policies and procedures are followed.

Council discussions during 2022/23

The Council held 12 ordinary meetings during the financial year. Attendance records of individual members can be found on the Institute’s website. Institute members can also read abridged minutes of the meetings, available in the Members’ area of the website.

At the ordinary meetings, the Council discussed matters including:

Strategy and governance

- Strategic action plan

- Strategy in Mainland China development

- Progress on the regulatory reform

- Sustainability standard setting

- 50th anniversary celebration

- Council composition and co-option of Council members

- Guidance on nomination of committee members

- Nominations to external bodies and appointments to the Institute’s boards and committees

- Nomination of Student Disciplinary Committee

- Membership appeal case

- Reports from boards and committees

- Policy and procedures for management of committee performance

- Management structure

Operations

- Regulatory matters

- Quarterly meeting with the accounting profession’s LegCo representative

- Audit fees

- Review of the Qualification Programme (QP) promotional activities effectiveness

- Consolidation of trusts

- Enterprise Risk Management

Advocacy

- Government budget

- Sustainability – Net-zero pathway

Human resources

- Salary and bonus review for general staff

- Performance review of Chief Executive and Registrar

- Change of the Chief Representative for the Beijing Representative Office

Committees

The Council is supported in its activities by various boards and committees. These ensure that the operations of the Institute’s management and other committees are aligned with the strategies and policies set by the Council through submitting periodic reports. Committees conduct meetings physically, with dial-in and virtual conference facilities also made available.

Committee nominations were sought in November 2022, with members invited to submit their names and CVs for consideration by the Nomination Committee. Committees were appointed for one year by Council in January 2023 after recommendations from the Nomination Committee.

Ordinary members of committees are generally subject to a six-year term limit on a particular committee, but may serve up to an additional three years as a deputy chairman and three years as the chairman.

The terms of reference of these committees can be found on the Institute’s website.

As a result of the further reform of the regulatory regime of accounting profession, the Qualification Oversight Board and Regulatory Oversight Board, as well as the Disciplinary Panels, Investigation Panels, Practice Review Committee and Professional Conduct Committee have been disbanded. As there are still ongoing disciplinary proceedings presided by members of the Disciplinary Panels, the terms of these individuals will continue until the conclusion of the relevant disciplinary cases. Committees that previously reported to the oversight boards, such as the Qualification and Examinations Board and the Registration Committee, will report directly to Council. These committees are statutory committees and are under the AFRC oversight. Governance-related committees will continue to report directly to the Council, while the remaining committees report to the Executive Committee in accordance with past practice. The tables here provide details about the responsibilities, significant matters considered or resolved, and membership of the oversight boards, governance-related committees, and Executive Committee.

Other committees, panels and working groups

Council also appoints other committees, panels and working groups covering a range of specialist topics and functions to assist it as it discharges its role and functions. Nearly 350 members of the Institute and over 70 non-members participate in committees. Details about these committees, including their composition and responsibilities, can be found on the Institute’s website.

Committees and panels |

Chairpersons and President |

|---|---|

| Disciplinary Panel (Panel B) | – |

| Qualification and Examinations Board | She Shing Pang, Paul |

| Registration Committee | Roy Leung |

| Auditing and Assurance Standards Committee | Paul Donald Hebditch |

| Branding and Communication Committee | Stephen Law |

| Corporate Finance Committee | Au Chun Hing, Edward |

| Ethics Committee | Mary Xuereb |

| Financial Reporting Standards Committee | Gary Stevenson |

| Greater Bay Area Committee | Lui Chi Wang |

| HKIAAT Board | Ng Kam Wah, Webster |

| Professional Accountants in Business Committee | Chan Ting Bond, Michael |

| Professional Development Committee | Roy Leung |

| Restructuring and Insolvency Faculty Executive Committee | Yeo Boon Ann, Kenneth |

| Small and Medium Practices Committee | Wong Chun Sek, Edmund |

| Sports and Recreation Committee | Agnes Ho |

| Sustainability Committee | Prof Robert Gibson |

| Taxation Faculty Executive Committee | Chan Ka Wah, Sarah |

| Young Members Committee | Wan Wing Yui |

Management of the Institute

Role of the President, and Chief Executive and Registrar

The President, and Chief Executive and Registrar undertake different roles for the Institute. The President is elected by Council members after the AGM for a one-year term and acts as Chairman of the Council and the public face of the organization for media purposes. The term of the President will be extended to two-year with effect on 1 November 2022 following the adoption of Professional Accountants (Amendment) Bill 2022 to enhance the election mechanism.

The Chief Executive and Registrar is appointed by the Council, serves as its secretary, and is responsible for the Institute’s operations and staff, while also serving a regulatory function as the registrar of CPAs in Hong Kong.

Institute’s management

The Chief Executive together with a management team of a legal counsel and seven directors, lead a group of 160 staff. More information about the management of the Institute can be found in Chapter 7 Finances and Operations.

Risk management and internal control system

An important aspect of governance and management best practices is to strengthen internal controls and to ensure that organizational risks are identified, assessed and managed in a timely manner. The Institute’s risk management structure is as shown in diagram below.

To maintain sound and effective internal control and risk management systems for the Institute, the management has established policies and procedures to ensure that procurement, payments and contracts are properly reviewed and authorized, assets and data are safeguarded as well as all company records are accurate and complete. Management meets regularly to review the operation and to update the policies and procedures, controls and reporting to ensure that they remain in line with relevant standards, laws and regulations for sound corporate governance.

The Audit Committee is appointed by the Council to assist the Council in fulfilling its governance and oversight responsibilities in relation to financial reporting and internal controls. The Audit Committee independently advises the Institute on its internal control system and relevant financial and risk management arrangements. The committee also considers the internal assessment of risks carried out by Internal Audit for determining the key areas of focus of the annual audit plan. This ensures the ongoing review of these controls is provided through the work of Internal Audit.

Internal Audit provides the Audit Committee and management with independent and objective assurance on the effectiveness and adequacy of the internal controls under review. The annual internal risk assessments undertaken by Internal Audit are formulated for the purpose of determining the key areas of focus in drawing up the internal audit plan. A yearly internal audit plan is prepared for review and approval by the Audit Committee. The scope of work includes financial and operational review, recurring and unscheduled audit, investigation and compliance review.

The Institute has a whistleblowing policy, which provides an independent reporting channel for employees and other parties to raise concerns (in confidence) about possible improprieties.

RISK MANAGEMENT STRUCTURE

Enterprise risks

The Institute attempts to proactively mitigate its exposure to risk through sound planning, effective management and the appropriate response strategies. The identified risks that may affect the achievement of our strategic goals are assessed and prioritized according to their consequence and likelihood. The key risks identified are summarized in the risk heat map and detailed in the table here. The risk impacts are subject to the development of the regulatory reform which is being monitored by the Institute. Please visit the Institute’s website for the latest information on the reform.